foreign gift tax canada

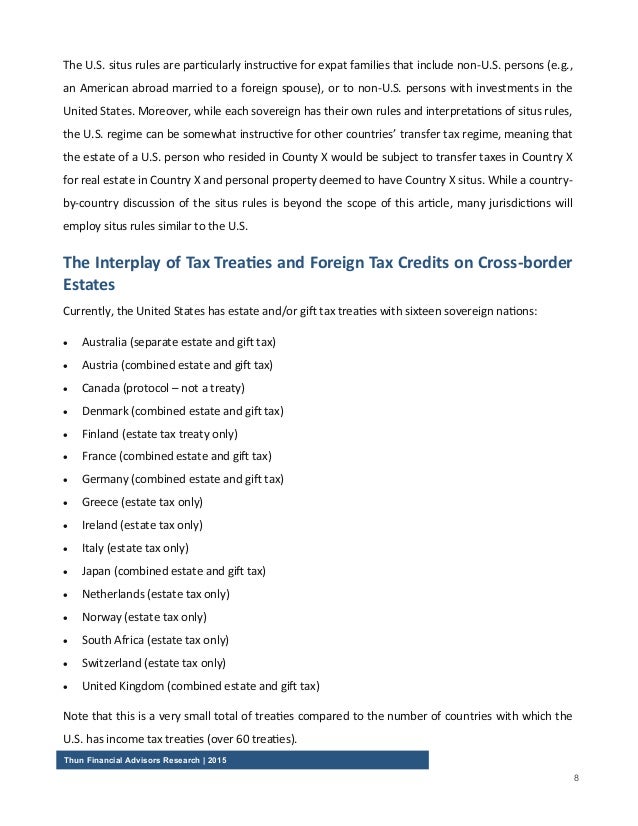

Treaties with estate andor gift tax provisions can be found at the International Bureau of Fiscal Documentations Tax. P113 Gifts and Income Tax 2021.

Guide For Residents Returning To Canada

Monetary gifts to Canada should be.

. Is There a Gift Tax in Canada. Person from a foreign person that the recipient treats as a gift and can exclude from gross income. In addition gifts from foreign corporations or partnerships are subject.

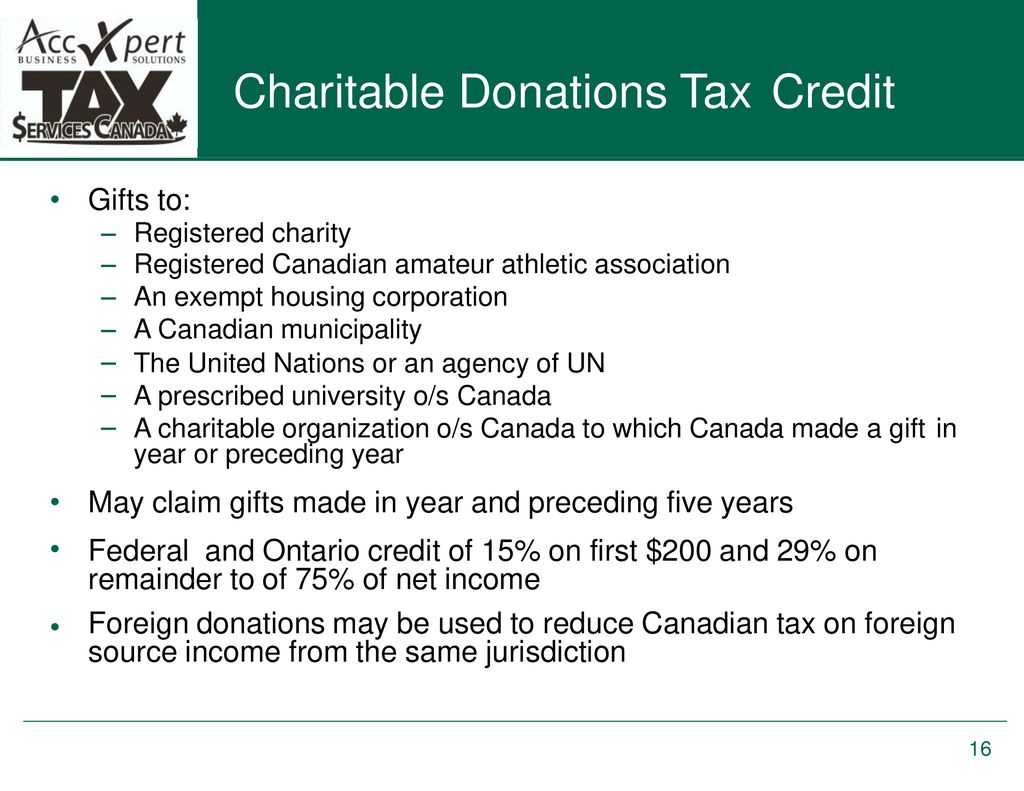

Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity. The amount that qualifies for the tax credit is limited to 75 of your net income. In short there is no gift tax in Canada.

You can view this publication in. In addition there is also no deductible. If you as a Canadian resident receive a gift you do not have to report it to the CRA and there shouldnt be.

Determine your adjusted cost base. 20 transaction fee 50 1 commission 500 cost of art supplies 570. In addition to the unified exemption both US.

There is no gift tax in canada so when your children receive gifts they. You will have to complete form T1135 to report your assets outside of Canada. Foreign Gift Tax Canada.

The IRS defines a foreign gift is money or other property received by a US. Person other than an organization described in section 501c and exempt from tax under section 501a of the Internal Revenue Code who. Heres how to calculate your capital gain.

Canadian tax law divides gifts into taxable and nontaxable categories. The gift tax rates range from 18 to 40 and reach the highest rate at 1 million of value. Enter the eligible amount on line 32900 of Schedule 9 Donations and Gifts.

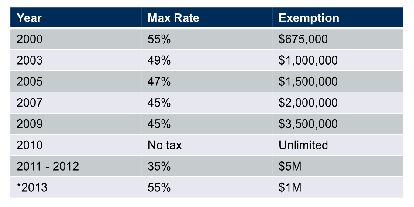

Any interest income earned on. The Canada Revenue Agency has no gift tax in Canada so if you have given or received money from someone there is no tax to be paid on this amount. Domiciliaries have an annual.

Canada does not impose a gift tax or an estate tax. The amount that qualifies for the tax credit is limited to 75 of your net income. As to the taxation of foreign gifts the general rule is that gifts from foreign persons are not taxed.

Canadians do not pay tax on foreign inheritances received. Reporting the Foreign Gift is a key component to IRS law. IRS Form 3520 is required if you receive more than 100000 from a nonresident alien or a foreign estate.

Gifting a capital property such as real estate shares bonds patents or trademarks entails a slightly different type of tax consequences. 16 rows Estate Gift Tax Treaties International US. But a key exception is when a foreign person Non-Resident Alien or NRA gifts US.

Depending on the type of gift the gift giver may have to pay the capital. If you are a US. The value of the gift or bequest received from a nonresident alien or a foreign estatewhich includes gifts or bequests received from foreign persons related to the.

International Tax Gap Series. While the value of the gifts is.

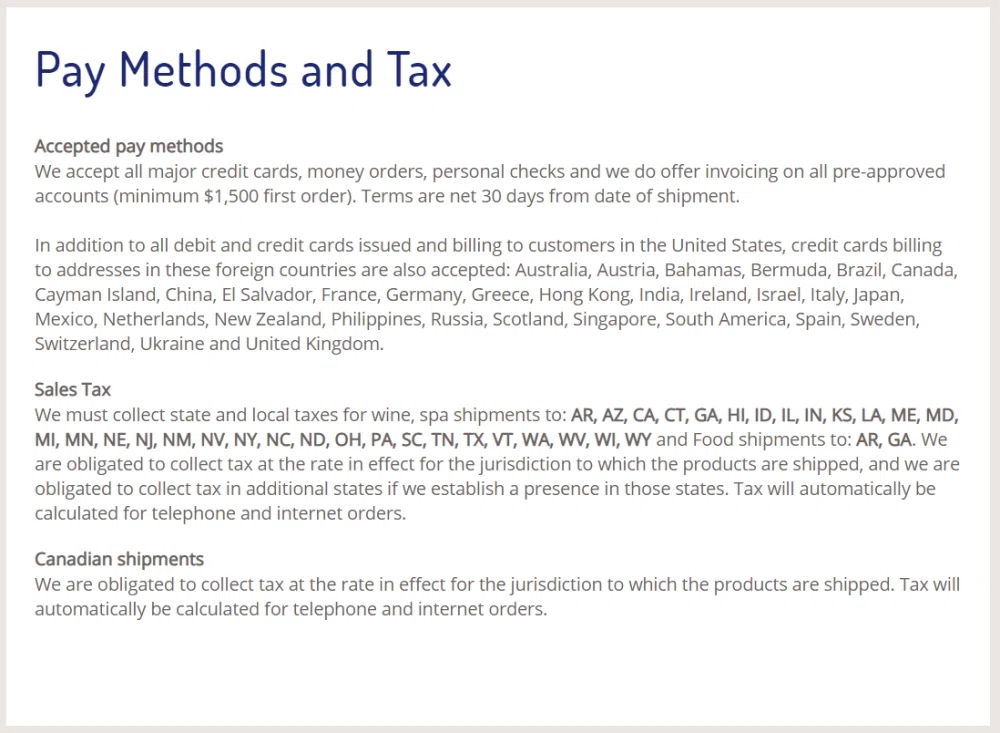

Wine Country Gift Baskets Debit Card Support Knoji

Taxes On Large International Money Transfers To Canada Finder Canada

Can A Non Us Citizen Create An Estate Plan In The Us Hellmuth Johnson

Taxes For Canadian Citizens Living In The Us 101 Tfx

U S Estate Tax For Canadians Manulife Investment Management

What S The Limit On Cash Gifts From A Nonresident Alien

International Information Reporting Forms Tax Expatriation

What You Can Bring Home To Canada Travel Gc Ca

Declaring Foreign Income In Canada

Must I Pay Taxes On An Inheritance From Foreign Relative

Tax Implications When Making An International Money Transfer

Canada Tax Income Taxes In Canada Tax Foundation

Gifts From Foreign Persons New Irs Requirements 2022

Wait Consider The Tax Consequences Before You Purchase A Vacation Home In The Us Property Taxes Canada

International Estate Planning For Cross Border Families

International Charitable Giving A Quick Guide To The U S Federal Tax Rules Martin Hall Ropes Gray Llp October Ppt Download

Income Tax Considerations Ppt Download

Gifting To Us Persons A Guide For Foreign Nationals And Us Donees Bny Mellon Wealth Management